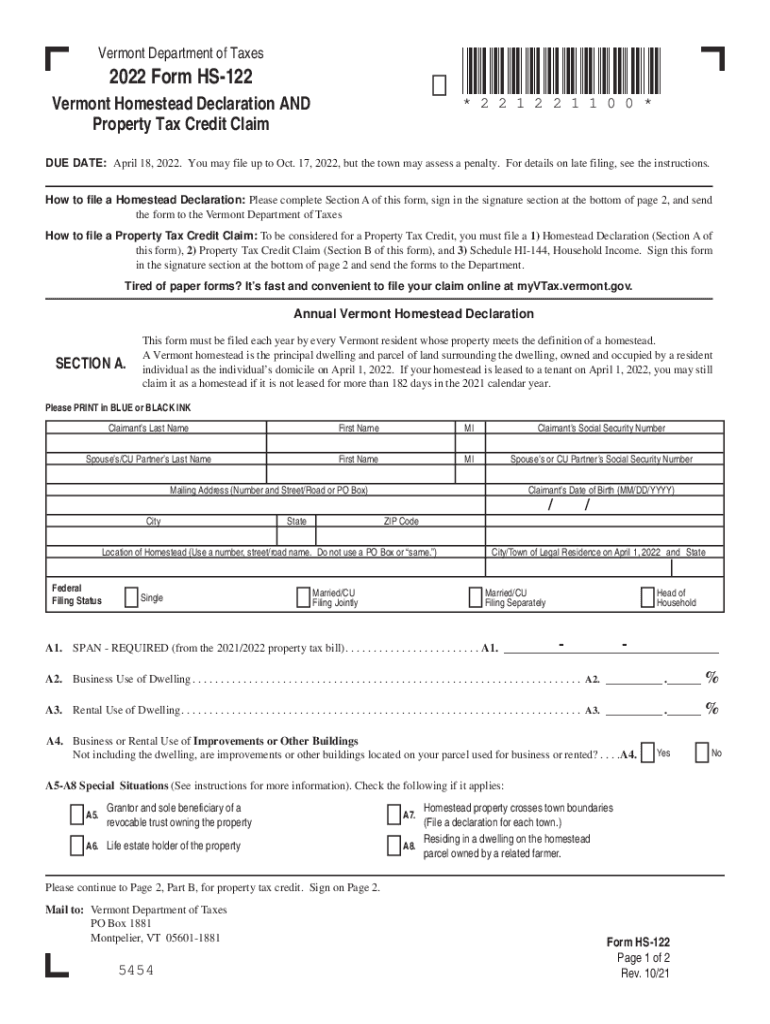

vermont department of taxes homestead declaration

Download or print the 2021 Vermont Form HS-122 HI-144 Homestead Declaration AND Property Tax Adjustment Claim for FREE from the Vermont Department of Taxes. Handy tips for filling out Vermont homestead declaration online.

Read In re Richardson Case 19-10525 see flags on bad lawD.

. Copy of Form 8379 if you filed this form with the IRS. Save Time and Money. And Documentation of your ownership interest.

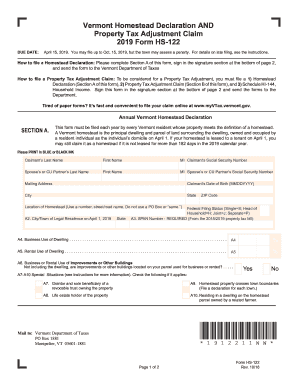

Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim. Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. Vermont Homestead Declaration AND Property Tax Adjustment Claim 2019 Form HS-122 DUE DATE.

This will reduce that portion of your total. Department of Taxes. Tax examiners in this division can.

Mon 01242022 - 1200. Professional Secure and High-Quality Forms. Printing and scanning is no longer the best way to manage documents.

The person not living in the homestead cannot make a Property Tax Credit Claim. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department. Ad Create Your Homestead Declaration Online.

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm. Please mail your claim to. Even if you do not believe you owe property taxes you must declare homestead in order to qualify for Property Tax Adjustment.

Filing a Homestead Declaration is easy and can. Once you have fulfilled the criteria you can apply for the exemption which will ensure that your state education tax rate is classified correctly. By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April.

Vermont Department of Taxes PO Box 1881 Montpelier VT 05601-1881 Form. Vermont Homestead Declaration Form HS-122 Section A. Get the Help You Need with LawDepots DIY Tools Today.

Those who are unable to meet the May 17 personal income tax filing deadline may file an application to extend to October 15 but taxpayers must still pay any tax owed by May. 2003 surveying Vermont homestead abandonment cases. Go digital and save time with signNow the best.

Filing a Homestead Declaration is easy and can be done online at. The Department may ask for a copy. All groups and messages.

Vermont Department of Taxes.

Hs122 Fill Out And Sign Printable Pdf Template Signnow

New Tool To Help Demystify Vermont Education Property Taxes

Vermont Department Of Taxes Youtube

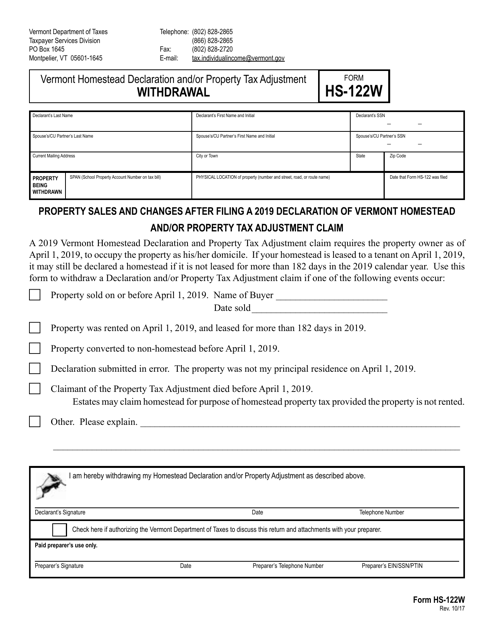

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vermont Tax Forms And Instructions For 2021 Form In 111

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

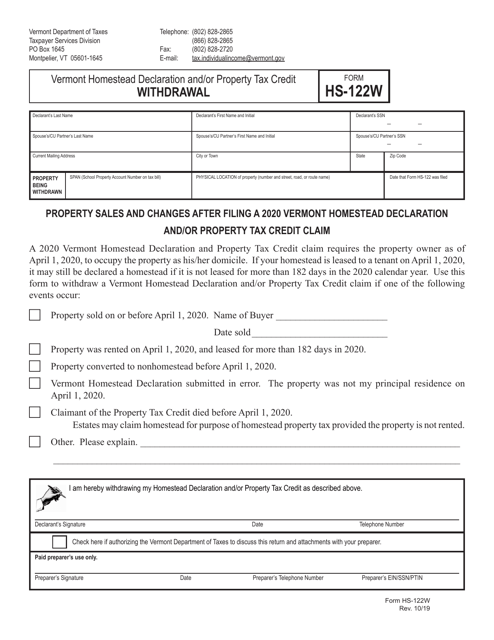

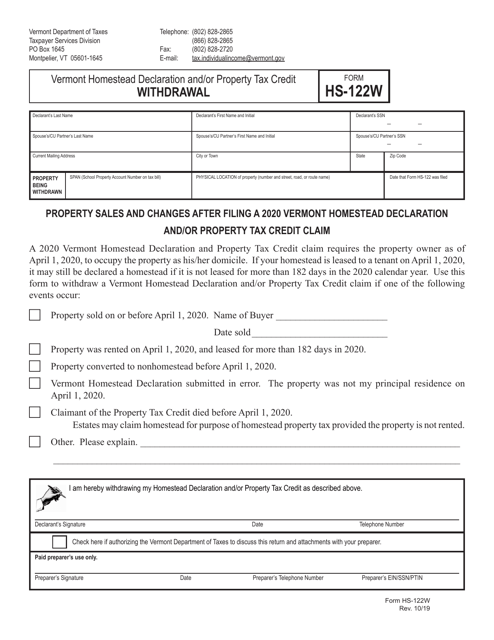

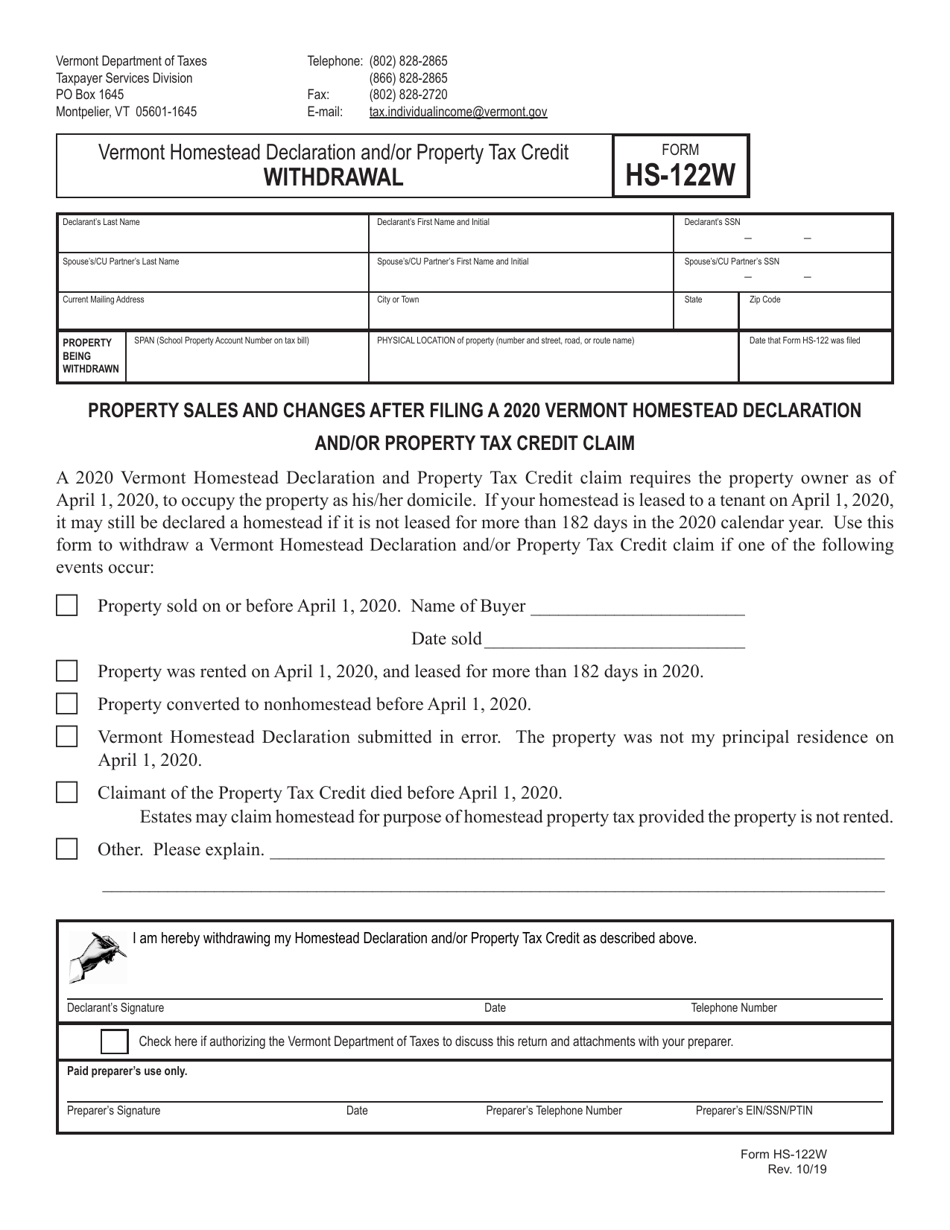

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller

2022 Vt Form Hs 122 Fill Online Printable Fillable Blank Pdffiller

2022 Vt Form Hs 122 Fill Online Printable Fillable Blank Pdffiller

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

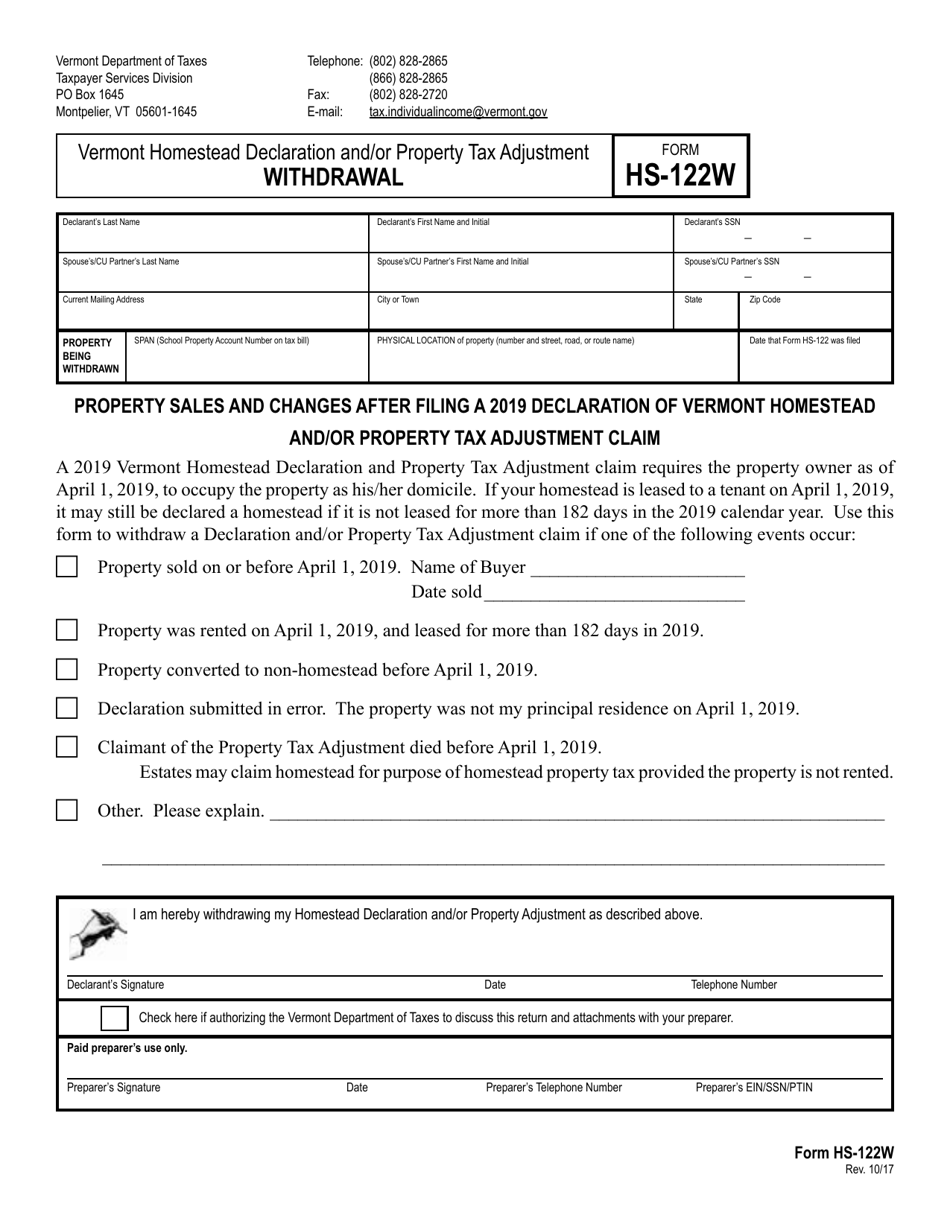

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller